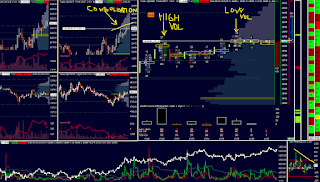

in my trading approach i use sentiment indicators - namely tick nyse and (for trading e-mini nasdaq) also tick nasdaq. these two are basically very important indicators to me, when it comes both to the reading market context, and timing entries.

we can for example observe that within days with high volatility (today and yesterday) tick nyse and tick nasdaq tend move more into their extremes and stay there for longer period of time

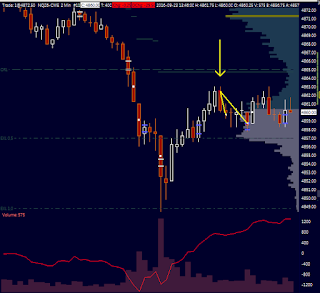

tick nyse (1 minute timeframe) - you can see it goes to extremes very often - up to 1200!! normally it stays within the red lines

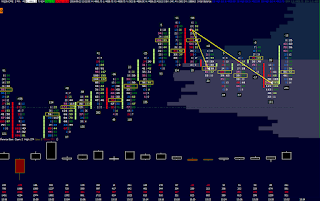

tick nasdaq (1 minute timeframe) has different limits for extremes but normaly it is very rare that it moves up to +400 or -400

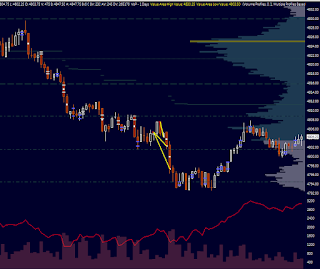

finally, the intraday chart of e-mini nasdaq (2 minutes timeframe) shows the market was not really trending and thus tick nyse and nasdaq should stay within red lines - but due to higher volatility - it goes into extremes very very often..

(the arrow is my short entry - very small one as i wanted to close at least small profit very quickly)

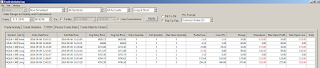

today i had the charts open just for 15 minutes really. took just one trade. - the trade management could be (and should be) much better but still, 135 usd within a minute is fine.