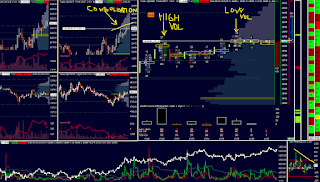

this is an example of an ordeflow pattern in a slow consolidating market, to make it clear:

- there is a high volume cluster with lots of buyers at 13:48

- after that the price consolidates

- and there is a breakout of the consolidation with low volume at 13:58 - that is the entry moment

of course there must be some other attributes that fits into the trade, but it is basically how this pattern looks like

and yes, the market dropped, but i was unable to take any profit on that ...

No comments:

Post a Comment