live intraday trading e-mini futures based on orderflow (tapereading), volume and intermarket analysis

2/25/2016

2/24/2016

selling pressure

2/23/2016

catching the low

2/19/2016

2/11/2016

2/09/2016

2/08/2016

a pullback against deep buyers in intermarket divergence

deep buyers on the low of the intermarket divergence, i am expecting a pullback against them, espcially if the YM creates such a nice market structure

2/05/2016

2/04/2016

2/03/2016

big guys in the market

today it was possible to trace the big money in the markets through orderflow and volume analysis on the footprints charts.. it was one the after-open-sell-off days..

2/02/2016

huge selling sentiment on the market´s open

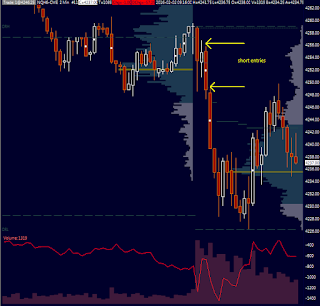

today nq opened with quite a strong selling sentiment. i was putting sell limit orders immediatelly after recognizing a known orderflow pattern. yet, again, no fill

the market ran down and here was another possible short entry based on times and sales. this one is more risky..

but.. it fell down pretty fast and to catch this kind of a selloff is almost a superhuman task

2/01/2016

the signal of the day

today´s best signal on nq, couple of minutes after open - market in a divergence with pretty nice orderflow on highest high and clever algorithmic action selling short..

feeling sorry for not catching, i was slow..

feeling sorry for not catching, i was slow..

.

Subscribe to:

Posts (Atom)