a video of one of my trades, two contracts only. i was trading somewhere outside in a park with a poor internet connection. not the best setup

live intraday trading e-mini futures based on orderflow (tapereading), volume and intermarket analysis

7/07/2017

5/10/2017

liquidity overturn on e-mini nasdaq futures

against late buyers in undervalued nasdaq 100 futures. here i have set up more advanced times and sales setting which i was testing for a couple of days or weeks.

sierra chart provides a good interface for times and sales and hopefully somewhere in the future i will provide a more in-depth description of what i observe on the tape

sierra chart provides a good interface for times and sales and hopefully somewhere in the future i will provide a more in-depth description of what i observe on the tape

exit after seller´s eruption

5/04/2017

htf smart selling activity

today on dow jones futures - hft algo as a response to offered liquidity. they tested the stability and hit the quoting bid.

i could not trade this situation because it didn't fit into my risk management. i waited for the price to make a little pullback up so that i could jump in, but it didnt.. and it continued downwardhere is the chart

i suppose these selling guys are smart, because they first tested if the offered liquidity is real, and when it appeared as true, they hit the waiting limit with a bigger sell market afterward - this "liquidity test" activity is useful for a subject that needs to open a bigger size and - and the same - doesn't want to move with price (zero slippage).

imagine, if you want to open a big sell position quickly (let's say 200 contracts), the best thing to do is to hit a big waiting limit on one level. but first, you need to be sure that the quoting limit is real, that it is real, not fake liquidity that will disappear when you pull the trigger.

so first, before you send a big market order, you send a "probe", a couple of small market orders to see, what will happen. if the quoting limits still stay there after being matched with your probes, it is REAL - the liquidity is there, waiting. if they disappear, it is NOT real and you should not open the bigger sell into it.

this is a technique of a subject that (1) wants to open a bigger size and (2) has a similar risk like me - because it is very precise when it comes to entry price, i can assume that the position will be liquidated in a very short time (just like mine)

here is how the footprint chart looks like in this area. an interesting thing to notion is that the falling market goes against deep buyers. this is a good orderflow context for short

4/28/2017

big subject activity on daily low - scalping algo breakout

this is what i have noticed today on daily low at e-mini nasdaq 100 futures somewhere around 13:10 chicago time

the interpretation of this visualization is this: near daily low a big rough market and a big sell market order of the same quantity appeared. it was immediately identified by an algorithm which started selling using sell markets in a "clever" manner.

at the same time, sell markets were supported with huge sell limit (on the depth of market as the white line). when no one wanted to buy this big amount and fill the huge sell limit, the subject starts selling in a harsh manner - using big sell market orders. the price drops a little bit down and the subject closes the position in a "clever" way using smart activity. taking profit.

the price made a small pullback up and the algorithm started selling again, using a high amount of sell market orders in a matter of (mili)seconds. at the same time, big sell limit appeared at the depth of market, was filled this time with a big buy market order and the price slides lower. the selling subject closed the position in a smart way, taking profit again.

again, it started opening bigger sell markets now to break the daily low. its big sell limits were strong enough to eat all the offered liquidity in the dept of market.

at the break of the daily low a 100-contracts big buy market order tried to protect the zone, but was neutralized with a 100-contracts sell limit. moreover, the 100 sell limit was supported with an even bigger sell limit (the size cca 230) accompanied with sell market in the size 120! it hit the daily low, closing the position in a clever way, taking its profit (yes again!) and reversing the position for long.

this is how a very powerful and very clever scalping algorithms operate..

this is where it happened in the chart (daily low - sensitive area)

this is how the footprint charts of the area looks like

4/22/2017

daily low stoprun

on friday late afternoon sellers broke the daily low and activated stoplosses of all the buyers who have bought within the day. this was the biggest candle in the whole day and - as usual- i was going against the visible movement and took long at the very low

i caught the low quite nicely, timing entry was based on sellers exhaustion. i openend only three contracts instead of six by mistake.

i caught the low quite nicely, timing entry was based on sellers exhaustion. i openend only three contracts instead of six by mistake.

here is how the last contract ended - exactly at the poc area

pretty great trade i would say..

this is how the situation looked like on a slower timeframe (30 min). there was an expanding separator bar from the previous day.

4/21/2017

unfinished auction

yesterday i took just one short on e-mini nasdaq based on orderflow gradation

and because some people asked me about an unfinished auction in trading orderflow - how to recognize it, how to interpret it, how to use it for timing entry or filtering, here is the answer.

here is a screenshot of an unfinished auction where u can see high volume at the highest levels of the fooptprint chart. it means the buyers are interested in buying at the high prices - that is why u can see them there, they are there, they accept this high price as ok for them, they keep buying. thus, there is no need to think about taking short for reversal because buyers simply want to buy for high prices and if buyers want to buy for high prices, the market will (most probably) rise. it is a very simple logic.

moreover, what you can see here is that high-sellers (the guys who sell the market for the highest price possible) are caught at the high prices. they try to sell, but the price don't fall. what does it mean? someone bigger is buying their sell market orders with buy limit orders, eating and absorbing all the high sellers.

this is how a fond or a bank opens their positions. a fond/bank needs to allocate a big size and they don't really care about the price. i mean, they care, but not so much because their primary aim is to allocate the big size into market.

they use both (1) active market orders at the highest prices and (2) passive limit orders for buying from the high-sellers. they generally open their positions at the breakout of new highs, because there is enough predictable liquidity that can be (ab)used.

they use both (1) active market orders at the highest prices and (2) passive limit orders for buying from the high-sellers. they generally open their positions at the breakout of new highs, because there is enough predictable liquidity that can be (ab)used.

whenever you see this market auction, do not short it!

4/18/2017

dow jones futures trading

today i traded only dow jones futures (ym), and it offered a number of opportunities. unfortunately i was not able to hit the further targets, except in one case.

all the four trades i took hit the first target but only one of them ran further. and that one was with the smallest position possible (2 contracts only), because the risk of that trade was higher. it is quite a shame, and pity taht i was not able to get more from today´s volatility.

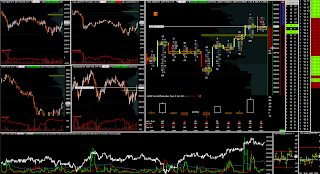

here is the intraday chart of e-mini dow jones in the first hour after open with my trades and comments

result

all the four trades i took hit the first target but only one of them ran further. and that one was with the smallest position possible (2 contracts only), because the risk of that trade was higher. it is quite a shame, and pity taht i was not able to get more from today´s volatility.

here is the intraday chart of e-mini dow jones in the first hour after open with my trades and comments

result

by the way, today i have noticed two iceberg orders (one at dow jones and the other at nasdaq futures 100).

still don´t know how to use it in my trading but it is an interesting thing to observe and follow the big guys through this visualization

here is the situation at dow jones where the iceberg was triggered after the price fell through bigger buy limit order (white line on market depth)

here is similar situation at nasdaq (in different time), but this one is not so strong

it is interesting to notice that the the price level where the iceberg sell order at dow jones started was not broken higher. in fact the market moved consolidated near daily low and after it sucked in enough buyers, it dropped deeper.

4/08/2017

dow jones sell off speculation on friday night

yesterday i took these two trades on dow jones futures. the first short after open was taken with 6 contracts, the second one with two only. the first trade had a runner with was planned to be closed somewhere near the low of the day,

unfortunately, the market filled my trailing stop precisely and dropped significantly afterward.

what was interesting at the second trade was waiting liquidity of the huge buy limit orders at the closing time.

here is the prinscreen, the white line on depth of market shows huge limit orders waiting to be filled. at first the price rebounds couple of time from this level.

unfortunately, the market filled my trailing stop precisely and dropped significantly afterward.

what was interesting at the second trade was waiting liquidity of the huge buy limit orders at the closing time.

here is the prinscreen, the white line on depth of market shows huge limit orders waiting to be filled. at first the price rebounds couple of time from this level.

at the end it went through filling all the waiting limits (cca 230 on one level). as these limits were filled, i closed the trade, because i expected the price to move higher. anyway, it didn´t. the market closed somewhere around near this level.

here is how the footprint chart looks at that particular place. you can see higher ammoung of sell market order paired up withthe waiting buy limit side (te low of the bar at 14:58)

here is the slower timeframe (30 min). the trade looks good, pity it was with a small position only

here is how the footprint chart looks at that particular place. you can see higher ammoung of sell market order paired up withthe waiting buy limit side (te low of the bar at 14:58)

here is the slower timeframe (30 min). the trade looks good, pity it was with a small position only

result +720 usd

4/04/2017

speculation on thin dom liquidity

an example of relative absence of buy limit orders on depth of market. this time i opened a trade speculating of overturn of liquidity and fall of price.

this is the intermarket state - not very clean but visible ..

the price should move sharply into the liquidity vacuum, penetrating the relatively smaller limits and hitting the first target.

in this case only the first target of 10 ticks was hit.. the price is extremely slow in these times..

4/01/2017

depth of market - thin vs. thick offered liquidity

here is an interesting situation on depth of market (dom) in intermarket state. it is easily visible that the offered liquidity on the bid side is much thinner that on the ask side.

it gives the (stupid) retail traders feeling that ym is cheap and that they should buy it. they start buying.

the presumption is that the price should move into the side of thinner liquidity - it is going to be easier, as there are no "walls" of waiting limit orders.

it is just a presumption now - no data have been collected to prove this idea.

what we have to take into account in such a situation is the intermarket state and the predictability of retail market orders. here we have ym under the daily low, all other markets are above.

limit side with quoting market maker´s orders builds thicker layers of sell limit order to retard the movement up and sell in a bigger quantity against the retail public. the movement down is much easier because the quoting buy limit side is weaker.

this is how the situatuion looks at market orders with depth of market. the offered liquidity on dom overtuns and the price sinks into it

this is how the situatuion looks at market orders with depth of market. the offered liquidity on dom overtuns and the price sinks into it

what happened next was that the price dropped down against the buying public. in this particular case it would have hit o the first target only but it doesn´t matter - there was a strong buying sentiment on nyse tick at that time and even thought the price went down to hit the stops of public..

here is the footprint chart of this situation

more in depth study of this phenomena needs to be done before taking these situation as a tradable edge

3/18/2017

friday late afternoon short

speculation on the reverze into the value area of the last three days..

the chart above shows a tiny intermarket divergence - ym is lower, compared to other 3 markets that broke their highs, thus i am speculating that ym WILL NOT break.

and it didnt..

the chart above shows a tiny intermarket divergence - ym is lower, compared to other 3 markets that broke their highs, thus i am speculating that ym WILL NOT break.

and it didnt..

3/13/2017

after rollover

today is the first day after rollover of futures contracts and the market is pretty lazy. i took two trades today, first at nasdaq at 8:41 long (only with one contracts as it was risky) and a second, which was a beautiful situation in orderflow - very clear exhaustion of buyers

this is the entry moment (mid - which i consider a very strong line and perfect orderflow situation)

this is the moment when i hit the first target making the position risk free

this is the entry moment (mid - which i consider a very strong line and perfect orderflow situation)

this is the moment when i hit the first target making the position risk free

and this is the second target

this the intraday price action with my trade - as you can see the range is pretty tight

result

3/07/2017

2/03/2017

2/01/2017

1/30/2017

orderflow gradation

this is an example of orderflow gratation entry - quite an aggresive one because it is only "half validated". but it was compensated with a nice potencial

i took a dradwon about 10 ticks and here i threw out two of three contracts to make the trade risk free. i am defining stoploss now

the cluster of buyers on the footprint chart made to cover the entry point. the third target goes quite far into the consolidation

yet.. it didnt work out..

result 130 usd.. not bad but if the third target was reached, there would be cca 300 usd..

there was only one tradable situation today and it was this one..

there was only one tradable situation today and it was this one..

Subscribe to:

Posts (Atom)