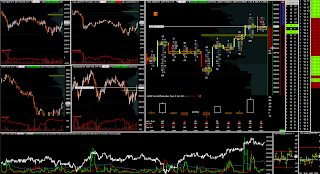

i took a dradwon about 10 ticks and here i threw out two of three contracts to make the trade risk free. i am defining stoploss now

the cluster of buyers on the footprint chart made to cover the entry point. the third target goes quite far into the consolidation

yet.. it didnt work out..

result 130 usd.. not bad but if the third target was reached, there would be cca 300 usd..

there was only one tradable situation today and it was this one..

there was only one tradable situation today and it was this one..