live intraday trading e-mini futures based on orderflow (tapereading), volume and intermarket analysis

4/29/2016

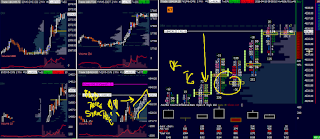

bad sign on times/sales and volume analysis

this is what i dont want to see when i am short - agressive sellers being eaten by the market. im trying to limit risk and get rid out of this position asap

4/26/2016

shorting nq low for break

4/22/2016

strong low in falling market

dow jones long after open

4/19/2016

4/18/2016

(half) legitimate loss

4/15/2016

market structure

4/13/2016

4/11/2016

4/05/2016

perfect rr

Subscribe to:

Posts (Atom)