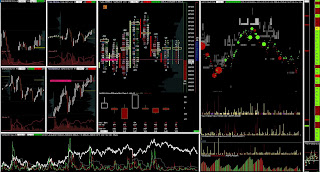

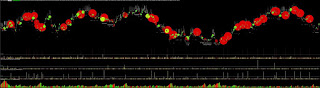

the session started in quite a fast tempo, and i expected to get a trade signal quickly. increased volatility should offer some signals to jump in, but it was not the case today.

the market auction was not readable and i could not find a low risk entry for oppening a trade.

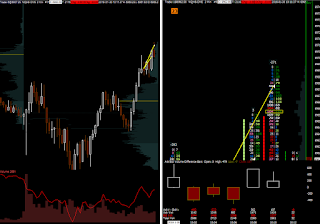

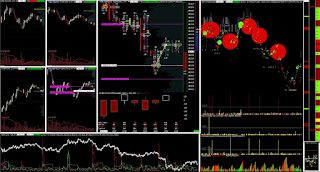

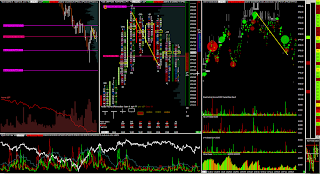

finaly, i found this situation.

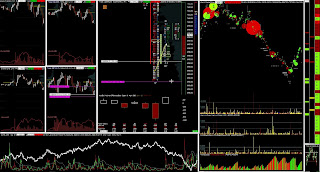

due to increased volatility i opened only half of my normal six-contracts position, prepared to compensate up to six in case the price will move against me to the level of stoploss while still holding the edge of the entry..

unfortunately, it did not happen, the price oscillated little bit back, but not enough to add to the position.

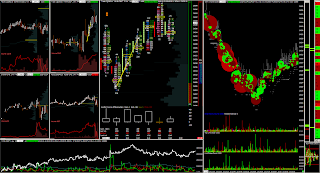

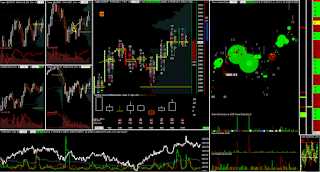

here is the exit

the exit was executed according to fixed (but due to increased volatility expanded) trade management.