there is a holy grail hidden in these numbers

number of trades bid vs number of trades ask vs bid volume vs ask volume etc..

this is what i am currently algo testing on sp500, dow, nasdaq, rty, crudeoil, heating oil, gold, silver, copper, 6a, 6b, 6c, and all other bunch of future markets

simple, easy, clean and fast

live intraday trading e-mini futures based on orderflow (tapereading), volume and intermarket analysis

6/28/2018

6/05/2018

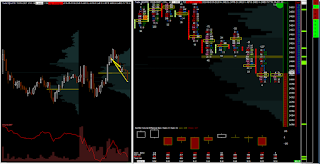

ym should fall down

today the open was really weak with low volatiltiy and tedious price action. i had to wait 1/2 hour for the first trade that i took right here.

form the dislocation of the markets i can assume that ym should move down, the orderflow is not the best but is quite allright. opening 4 contracts.

it took a little drawdown but the price slided as expected..

here i have 3 contracts from 4 cloesd and the trade is risk free

.

form the dislocation of the markets i can assume that ym should move down, the orderflow is not the best but is quite allright. opening 4 contracts.

it took a little drawdown but the price slided as expected..

here i have 3 contracts from 4 cloesd and the trade is risk free

.

the final contract is closed after the seller´s emotion

it was the one and only trade becaus the price action was really slow.

6/03/2018

super-bad backtest results from a super simple acsil code

i have been doing some acsil coding sierra chart lately and built up a couple of new setups.

sometimes it is quite time-consuming and difficult to build a good strategy that returns nice results.

of course, backtest are not the only thing to weight and worry about, but it is definitely the first thing u see.

the worst backtests are not the one that had poor results but the ones where the profit factor is somewhere around 1,00. it means that the profits and losses are equal.

some might think that the worst backtests are simply the ones with the worsts result, but no, that is not necessarily true. at least not for me..

because when i find a strategy that is really poor and loses 9 times out of 10 entries, i can simply change the direction for each entry and... voila, i got a pretty good scoring one.

today i run a backtest that returned really horrible results. i mean, i have never run a test that would be as bad as this one.

it has 0.23 profit factor which means that from each 5 entries, 4 of them go to sl..

i tested only 40 days, but the number of trades is 505 which is quite high.. so yeah, it might say something..

next step?

reverse the position and run it on a longer frame..

maybe, this piece of crap will become one of the most profitable strategies in the entire freaking universe :-)

who knows..

sometimes it is quite time-consuming and difficult to build a good strategy that returns nice results.

of course, backtest are not the only thing to weight and worry about, but it is definitely the first thing u see.

the worst backtests are not the one that had poor results but the ones where the profit factor is somewhere around 1,00. it means that the profits and losses are equal.

some might think that the worst backtests are simply the ones with the worsts result, but no, that is not necessarily true. at least not for me..

because when i find a strategy that is really poor and loses 9 times out of 10 entries, i can simply change the direction for each entry and... voila, i got a pretty good scoring one.

today i run a backtest that returned really horrible results. i mean, i have never run a test that would be as bad as this one.

it has 0.23 profit factor which means that from each 5 entries, 4 of them go to sl..

i tested only 40 days, but the number of trades is 505 which is quite high.. so yeah, it might say something..

next step?

reverse the position and run it on a longer frame..

maybe, this piece of crap will become one of the most profitable strategies in the entire freaking universe :-)

who knows..

Subscribe to:

Posts (Atom)