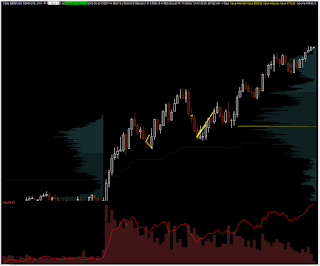

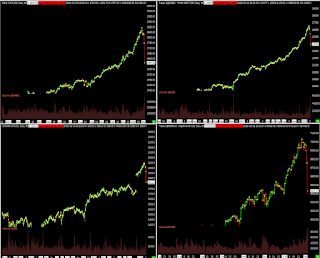

this is the reason why i trade within intraday timeframe and don´t invest long term

i can hardly remember when i saw something similar and i would NOT like be a long-term buy-and-hold investor these days.

in the markets, there applies a simple formula: the longer the timeframe, the lower the probability of guessing the correct direction

no, i don´t believe in long-term investing. it is a fake idea. all these investing gurus, buffet, hedge funds managers etc.. no one knows what is going to happen on the markets within one hour, how can they say what will happen within a week, month or a year?

short-term investing makes sense to me much more.

i am able to say what is going to happen in my life within one minute from now. much less i can say what is going to happen within one day from now, even less within one week and i have an idea what is going to happen with a year or more..

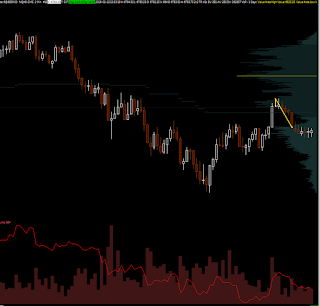

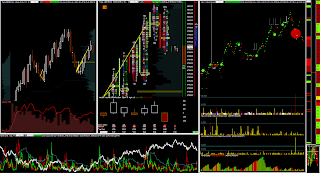

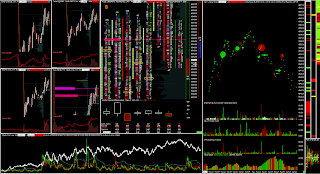

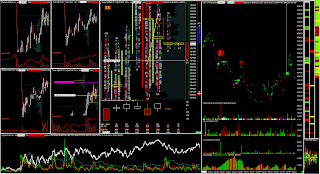

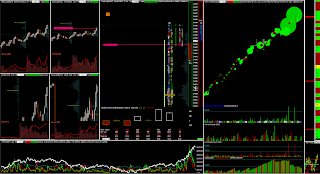

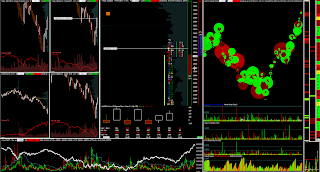

in the same way it is in the markets. i can quite accurately say what is going to happen with the price within a couple of seconds or minutes. that is all i need to do day trading.

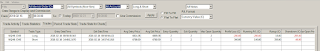

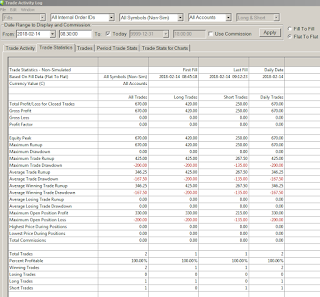

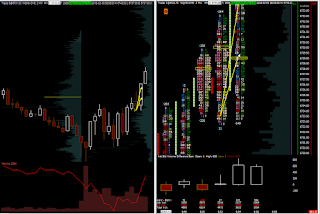

for example today, i took one trade that lasted a couple of minutes. and by the way, it was a long trade! hah.

this was quite an easily readable long entry, due to increase volatility i took only 2 contracts. +330 usd was the result within a couple of minutes. stress-free trading