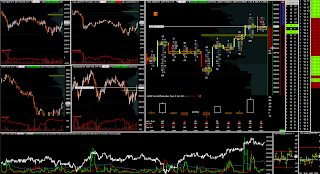

in the first case, market orders reveal huge sell market orders and the price move against it. in the second case, it doesn't reveal any aggressive sell market orders.

this is the footprint chart

this is how it happened

this might be one of the way how to discriminate between aggressive and tender approach through wmo and out filter some falls signals and infilter some missed opportunities. not necessarily always huge cluster in my way is a negative signal for entry. but it needs more in-depth study of this phenomena