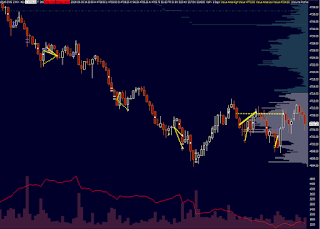

the dramatic change in the volatility compared to the previous day might have been due to the ecb meeting that took place on thursday or other things (disappointing apple iphone 7, hah..). whatever it was, it caused market to fall and especially at e-mini nasdaq futures (nq) it was easily observable there was some big money secretly building huge short positions - mostly at the beginning of the session.

the market auction showed prevailing nervousness - the price jumped through many levels within a second when a market order was put into the place, quoting limit orders on depth of market were moving out, the liquidity on the first-price-touch was lowered - these are all symptoms of changed environment and one needs to count with it.

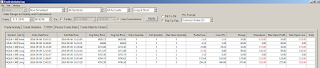

i started my trading later - these days i don´t have time to trade the open - and my priority was definitely to jump short. couple of times, it happened that the market did not fill my limits because the liquidity was weakened..

at the end of the day, i took couple of trades on the long side because i noticed the sentiment of the market changed

No comments:

Post a Comment