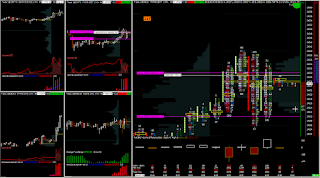

the first one was here as a speculation for a breakdown. the entry was quite aggressive and the risk of the trade was not properly calculated before triggering.

i assumed the price would slide down really quickly, but it did not happen. it wen up so here i closed the trade in a loss of cca 250 usd

good point on this trade was that i jump out really quickly, without any hesitation. these are situations that need to reverse immediately and if they dont, i get out.

another trade was one or two minutes after the first one.

here i am short at dow jones - opening 4 contracts as well as in the previous one but the last on was not filled. i assumed the price should not go above high where i would close the whole position

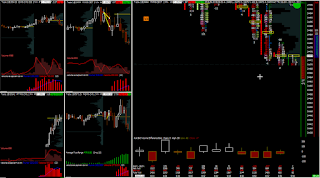

here is the exit. in fixed trade management. with only three contracts cca +250 so i zeroed out the previous loss.

here i was ready to open aanother short at ym again, but i waited the price to tick little bit higher so that i could place my stoploss into the safe area above high easily..

yet, it did not go any higher, so the drop was without me...

No comments:

Post a Comment